Chinese Anti-Monopoly Regulator Accepts First Merger Control Filing Involving Variable Interest Entity (“VIE”) Structures

On April 20, 2020, China’s State Administration for Market Regulation (“SAMR”) published on its website a notice in relation to the merger review of a simple case of concentration of operators, the Shanghai Mingcha Zhegang Management Consulting Co., Ltd. and Huansheng Information Technology (Shanghai) Co., Ltd. Newly Established Joint Venture Case (the “SMZ Case”).[1] This marks the first time that SAMR has officially accepted a merger control filing for concentration of operators (an “AML Filing”) in respect of a transaction in which the VIE structure was adopted by a party to the transaction.

At present, it is market practice not to make an AML Filing with respect to transactions involving VIE arrangements as up until the SMZ Case, SAMR had not officially accepted or cleared any filing in relation to transactions involving VIE arrangements, and it was the consensus among stakeholders that SAMR would likely continue to do so. There was no clear basis in law for SAMR to refuse such filings. PRC counsel have advised that SAMR has refused to accept these filings as it did not want to be viewed as giving a stamp of approval to the VIE structure by accepting and clearing such an AML Filing.

Therefore the SMZ Case represents a milestone in the history of PRC regulatory authorities’ long-running love-hate relationship with VIE structures and signifies that the existence of VIE arrangements may no longer constitute an obstacle to the making of AML Filings.

Background

Shanghai Mingcha Zhegang Management Consulting Co., Ltd. (“Mingcha Zhegang”) and Huansheng Information Technology (Shanghai) Co., Ltd. (“Huansheng Information”) proposed to set up a joint venture to engage in information technology and network technology development in the catering industry, data processing, artificial intelligence application software development, artificial intelligence hardware development and other businesses, and to explore new models of industry-research cooperation to provide more technical solutions for the catering industry. Upon establishment of the joint venture, Mingcha Zhegang and Huansheng Information will respectively hold 60% and 40% of its equity and will jointly control the company.

The group to which Huansheng Information belongs owns chain restaurant brands like KFC, Pizza Hut, Taco Bell, East Dawning, Little Sheep and COFFii & JOY. It is mainly engaged in western fast food, Chinese fast food, hot pot catering, casual catering and other businesses in the PRC. The ultimate controller of Huansheng Information is Yum China.

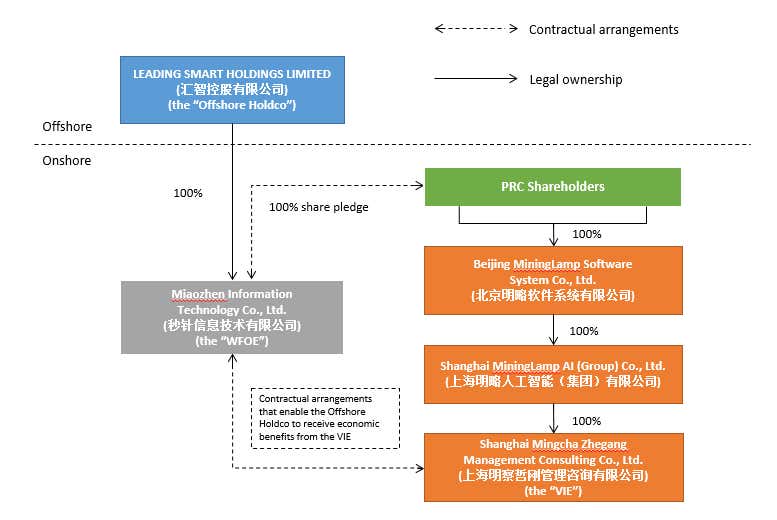

The principal business activities of the Mingcha Zhegang group include providing enterprises in the catering industry and government departments with artificial intelligence solutions. According to information disclosed in a public notice, Mingcha Zhegang’s ultimate controller is Leading Smart Holdings Limited, a Cayman Islands company, which maintains control over Mingcha Zhegang, a purely domestic company, through related entities based on a series of contractual arrangements, as illustrated below.

Observations

The VIE structure has been used extensively to facilitate offshore financing of Chinese businesses in the TMT and other industries, thereby enabling foreign strategic investors to enter these sectors despite foreign equity ownership restrictions or prohibitions under PRC regulations. The continuing existence and validity of the VIE structure came into question on January 19, 2015 when the Ministry of Commerce of the PRC released, for public comment, a draft of the Foreign Investment Law (the “FIL”), which reflected a clear intent to restrict usage of the VIE structure as a way to circumvent Chinese foreign investment rules.

Between 2015 and March 15, 2019, when the final version of the FIL was enacted, many commentators speculated as to whether the final version of the FIL would include these provisions about VIEs and what specific exceptions would be included to allow major listed companies such as Alibaba, Tencent, Baidu and many others that use the VIE structure to continue operating their businesses in China. Some commentators stated that the delay in enacting the final FIL was at least in part due to an internal government struggle over how to treat VIEs. When the final version of the FIL was enacted it included no provisions concerning VIEs. Again, VIEs were in a “grey area” under PRC law, not clearly permitted or prohibited.

The formal acceptance by SAMR of the SMZ Case may signal that the VIE structure has finally come out of such “grey area” and obtained formal recognition from the regulatory authorities (or at least from SAMR). It is now possible that SAMR, having accepted an AML Filing involving a VIE structure, will step up its enforcement actions and expect transaction involving parties with VIE structures to more proactively assess their situations and make AML Filings if required. Market participants should refresh the advice they previously obtained on AML Filings with respect to transactions involving parties with VIE structures to confirm whether the “no filing strategy” that up until now has been widely adopted by market participants is still the best strategy.

As further explained in the Terms / Notices linked below, the information provided herein does not constitute legal advice. Any information concerning the People’s Republic of China (“PRC”) is not intended and shall not be deemed to constitute an opinion, determination on, or certification in respect of the application of PRC law. We are not licensed to practice PRC law.

[1] http://www.samr.gov.cn/fldj/ajgs/jzjyajgs/202004/t20200420_314431.html.

- Marcia EllisGlobal Co-Chair of Private Equity Practice

- Rony P. GerritsSenior Counsel