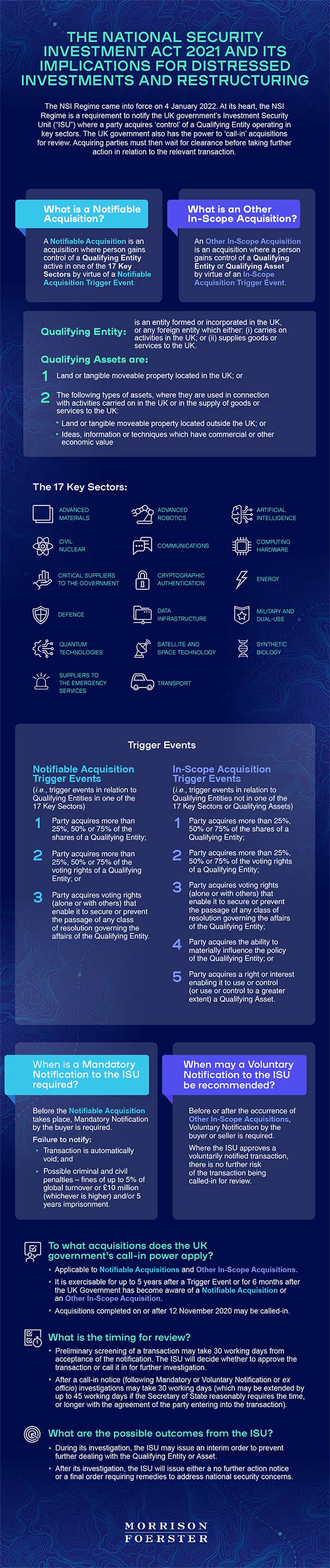

The National Security Investment Act 2021 and its Implications for Distressed Investments and Restructuring

The National Security Investment Act 2021 (the “Act”) came into effect on 4 January 2022 and introduced a new UK investment screening regime focused on national security risks (the “NSI Regime”). It is similar to the Committee on Foreign Investment in the United States (“CFIUS”) regime. The Act is wide reaching; it provides the UK government with the power to review and intervene in transactions that may pose a UK national security risk due to a transfer of control of sensitive entities or assets.

The NSI Regime affects companies engaging in acquisitions with a UK nexus and will affect buyers, lenders, security agents and insolvency practitioners (“IPs”) in certain circumstances. This article explores these transactions.

For background on the Act and the NSI Regime, please see our November 2020 Client Alert, May 2021 Blog Post, and August 2021 Client Alert.

1. A Brief Overview of the NSI Regime

The NSI Regime came into force on 4 January 2022; accordingly, its operation in practice is still evolving. Lenders, security agents, distressed debt investors, and IPs should carefully assess the application of the Act in any situations where the control (via shares or voting rights) of or the ability to materially influence a qualifying entity is changing.

2. Relevance of the NSI Regime to Lenders and Security Agents

A. Acquisition Financing

In the case of acquisition financing (i.e., where lenders are financing an underlying transaction), it is important for lenders to consider whether the entity or asset is a qualifying entity or qualifying asset, which may require a review under the NSI Regime. While the primary notification obligation would fall on the main parties to the transaction, given the consequences for non-compliance with the NSI Regime, it is prudent for lenders to carry out their own due diligence and consider seeking a legal opinion on the applicability of the NSI Regime to the transaction.

In the event a mandatory notification obligation arises for an acquisition, lenders providing financing should consider the inclusion of protections in the finance documents. This may include the inclusion of conditions precedent, representations, undertakings and events of default clauses, which require parties to consider the application of the Act to the transaction to mitigate the risk of a call-in under the Act.

B. Loan Agreement

The granting of a loan is unlikely to pose a risk to national security, including where the loan is provided to companies within one of the key sectors. However, loans may still be scrutinised under the NSI Regime. They may fall squarely in the scope of the NSI Regime where:

i. the loan agreement provides the lender(s) with control or material influence over the borrower or the security granted by the borrower (see below for more detail); or

ii. the borrower’s activities may trigger mandatory notification or a call-in by the government.

It is not common for loan agreements to give the control rights detailed in i. above, however, lenders should be mindful of unintentionally triggering the NSI Regime. For example, a lender or a syndicate of lenders may have a material influence over the policy of a qualifying entity when the borrower is distressed and has no other option but to do what the lenders want. In such circumstances, the ‘acquisition of control’ may be subject to a call-in. A voluntary notification should be considered, particularly if the borrower operates in one of the 17 key sectors.

C. Security

Entering into Security Documents

Entering into share security in which (i) shares of a qualifying entity are pledged, or (ii) a qualifying asset is secured, will not usually provide lenders with material influence over the policy of an entity at the outset and is thus unlikely to trigger the application of the NSI Regime. Neither circumstance will give control or an absolute right over the entity or asset (as applicable) to a lender, unless the right is expressly granted. The security would usually need to become enforceable for the control to arise. If, however, control or material influence is expressly given on the creation of security, notification to the UK Investment Security Unit (“ISU”) would be required before entry into the security document.

Events of Default and Enforcing Security

An event of default will not on its own trigger the application of the Act. However, the Act may be triggered on the enforcement of certain security following an event of default.

Where a borrower has granted security over:

i. shares of a qualifying entity, which operates in one of the 17 key sectors and the security becomes enforceable (i.e., there is transfer of shares or voting rights to a security agent or person entitled to the shares), a mandatory notification may be required;

ii. a qualifying asset, and the enforcement of security would entail the transfer of a right to use or control (or to use or control to a greater extent) of a qualifying asset, a voluntary notification may be recommended; and

iii. shares of a qualifying entity, which does not operate in one of the 17 key sectors and the security becomes enforceable, the need for a voluntary notification should be assessed.

What should lenders and security agents do if notification is required?

Where notification is required, lenders and security agents should seek approval from the ISU before taking enforcement action. They should ask for approval as soon as possible after being notified of an event of default.

Lenders should ensure that the loan agreement requires the borrower(s) to notify the lenders or security agents of potential events of default. Greater notice will enable lenders to send a notification to the ISU in good time, and subsequently enforce security faster following ISU approval.

3. Relevance of the NSI Regime to IPs

IPs must consider whether an action, such as a restructuring or reorganisation, distressed sale process, or their appointment as an officeholder, falls within the scope of the Act given the consequences of non-compliance with the Act.

A. Appointment of Administrators

The Act provides that the appointment of an administrator or foreign office holder will not trigger the application of the NSI Regime, as there is an express carve-out applicable to the appointment of an administrator.

If the administrator is seeking to dispose of shares or assets owned by the insolvent company, the sale may trigger the NSI Regime (see Insolvency Sales below).

B. Appointment of Liquidators or Receivers

The Act does not clarify the position where a liquidator or receiver is appointed; there is no express carve-out for the appointment of a liquidator or a receiver as in the case of an administrator. Under the Act, a ‘trigger event’ takes place when a person gains ‘control’ of a qualifying entity or qualifying asset. A person gains ‘control’ of a qualifying entity or qualifying asset if the person acquires a right or interest in, or in relation to, the entity and as a result one or more of the trigger events in the infographic above occur. As such, before the appointment of a liquidator or receiver, it is important to assess whether a mandatory notification is required due to the company falling within one of the 17 key sectors and, if not, whether a voluntary notification would be prudent.

As above, if the liquidator or receiver is seeking to dispose of shares or assets owned by the insolvent company, the sale may trigger the NSI Regime (see Insolvency Sales below).

C. Insolvency Sales

The Act does not contain a carve-out for the sale of a business or asset in an insolvency process.

Share sales or debt-for-equity swaps

A mandatory notification would likely be required where there is a:

i. share sale of a qualifying entity operating in one of the 17 key sectors; or

ii. debt-for-equity swap in relation to a qualifying entity operating in one of the 17 key sectors, depending on the percentage of shares or voting rights that are issued.

It will be important for parties contemplating such transactions to take into account the time necessary for a review by the ISU.

Asset sales

An asset sale (i.e., the sale of a qualifying asset) will not trigger a mandatory notification. Parties to the sale should, however, consider the applicability of a voluntary notification if the officeholder or receiver is selling qualifying assets. While UK government guidance provides that the acquisition of assets is likely to be called in less frequently (in comparison to the acquisitions of entities), assets are most likely to be at risk of call-in if the asset is used in one of the 17 key sectors (or closely linked activities).

4. Relevance to Parties in Distressed Acquisitions

Distressed Share or Asset Purchases

Where the sale of a company requires a mandatory notification under the NSI Regime, clearance is required before the transaction can complete (otherwise, the transaction will be void and parties are at risk of substantial fines as well as criminal penalties). The obligation to notify the ISU in the case of a mandatory notification rests with the buyer; whereas, voluntary notifications may be made by the buyer or the seller of the asset. Share purchases may fall under either the mandatory or voluntary notification regime, while asset purchases are only subject to the voluntary notification regime.

In either case, where notification is applicable, from the date of acceptance of the notification by the ISU, the ISU has an initial 30 working day period to clear the transaction or provide a call-in notice. If a call-in notice is issued, the ISU has a further 30 working days, which can be extended for another 45 days to review the transaction. The sale of a distressed company is often time sensitive; given there is no mechanism for expediting clearance applications, the process of obtaining approval may be problematic. Given the urgency with which clearance will need to be sought, it is important to ensure that all parties are aware of the ISU notification process and of the need to work together to ensure that a notification can be made as quickly as possible, notwithstanding where the responsibility of notification falls.

Conclusion

The introduction of the NSI Regime also introduces the possibility of delays in high-risk, time-sensitive transactions. The relevant transaction parties must be mindful of the applicability of the NSI Regime, and look to make notifications as early as possible. Lenders and security agents should be careful when looking to enforce security. Further, IPs have to exercise caution where their appointment, or a transaction, may fall within the NSI Regime, until further guidance has been issued.

Julia Kotamäki, London trainee solicitor, contributed to the drafting of this alert.

Marie-Claire StrawbridgePartner

Marie-Claire StrawbridgePartner Stuart AlfordPartner

Stuart AlfordPartner