Key M&A Trends for 2020

Global M&A made another strong showing in 2019, as stock markets, while at times bumpy, rose to new highs, private equity firms raised record funds, and companies searched for growth and ways to address technological and other disruptions. The performance was all the more impressive given fears of potential recessions or stock pull-backs in various markets, increasing trade disputes, heightened national security and competition concerns, and other challenges.

Global Activity

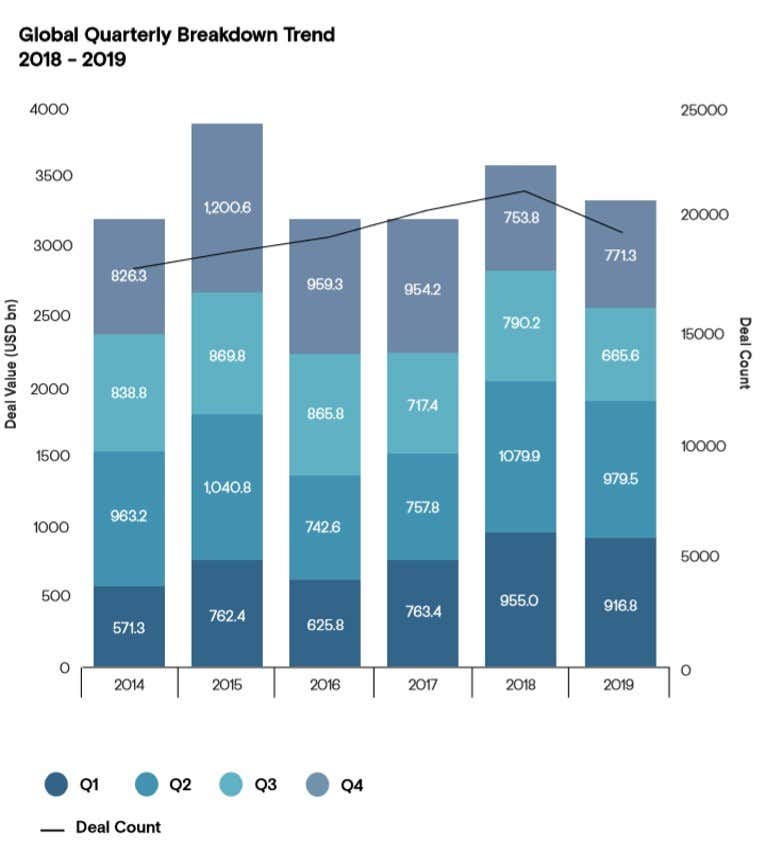

Global M&A value in 2019 lagged behind 2018 numbers for much of the year, but a surge of deals in the fourth quarter drove value to $3.9 trillion, just 3% lower than 2018, making 2019 the fourth biggest year for M&A since 1980. M&A value rose for deals in the United States and Japan, but fell for deals in Europe and the rest of Asia. Healthcare, technology, and energy were the most active sectors, accounting for about half the overall volume.[1]

Source: ![]()

www.mergermarket.com

Tech Activity

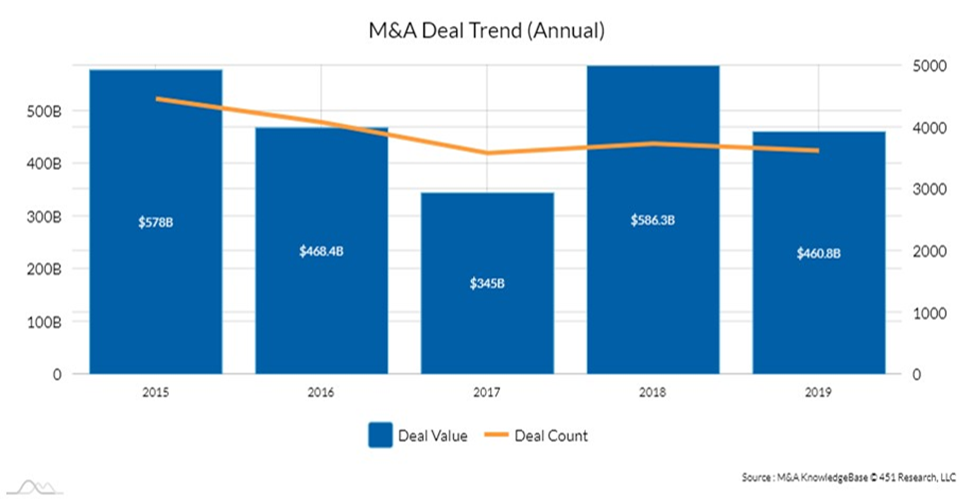

Tech M&A value in the first quarter of 2019 exceeded that of the first quarter of 2018. As the year ended, tech M&A deal value had fallen from that of 2018, but the number of deals remained strong.

Tech M&A Deal Activity by Year (2015-2019)

Source: 451 Research’s M&A KnowledgeBase

Healthcare Activity

The strong healthcare M&A market that began in 2018 continued in 2019, with mega-mergers like Bristol-Myers Squibb and Celgene, Danaher and General Electric’s biopharma business, and Centene and Wellcare. Healthcare M&A outpaced M&A overall, with value rising about 26% over 2018.[2]

Cross-Border Activity

Cross-border M&A fell to $1.2 trillion, the lowest total since 2013[3] and below the average proportion of overall M&A, in the face of concerns over regional economies and international and domestic political tensions, including trade disputes and uncertainty over Brexit.

Many of these trends will continue into 2020. The new year is also an election year in the U.S., and companies will be watching for signs of changes that might affect prospects for growth or the costs, or benefits, of M&A. But with stock prices high and cash available, companies have the resources to make acquisitions as they find opportunities.

In this alert, we review some of the key developments arising from last year’s M&A activity, and consider how they might affect the level of M&A and how deals are done going forward.

Learn more about Morrison & Foerster’s Global M&A Practice.

1. Privacy Laws Expand in the U.S. and Globally

M&A dealmakers are scrambling to keep up with significant changes in privacy laws in the U.S. and other countries, both to assess the impact on potential deal value and to implement appropriate compliance measures. Although particularly important for transactions involving data-driven companies, these changes affect virtually all companies in some fashion.

- Prominent among these changes is the California Consumer Privacy Act (CCPA); which as of January 1, 2020 created landmark rights for California residents to request access to the personal information that companies maintain about them, request deletion of that information, and opt out of the “sale” of their personal information. Moreover, CCPA allows California residents to file civil lawsuits for certain types of data security breaches. California’s new IoT data security law and new data broker law also took effect in January 2020.

Visit our CCPA Resource Center.

- Nevada modified its online privacy law to give individuals a right to opt out of the sale of their personal information (albeit relatively narrower than the right provided under the CCPA). Over a dozen other states are considering expansive new consumer privacy legislation. The expansion of state law initiatives has also led to more vocal proposals for a federal privacy law.

Visit our GDPR Resource Center.

- The EU's General Data Protection Regulation (GDPR) generated record-breaking fines, including a €50M fine against Google by the French data protection authority for alleged violations of GDPR’s transparency, information, and consent requirements in deploying targeted advertisements. The forthcoming ePrivacy Regulation is likely to have an even greater impact on the use of cookies and similar technologies, interest-based advertising, and other collection of data from users’ devices.

- Beyond the U.S. and EU, privacy laws are expanding globally as well.

2. The Blockchain Industry Consolidates and Matures

The blockchain industry ripened as a vector for M&A, joint ventures, and other strategic transactions during 2019. Noteworthy transactions included the acquisitions of cryptocurrency derivatives trading facilities (such as Kraken’s acquisition of Crypto Facilities), blockchain-enabled payment remittance companies, and custody services (such as Coinbase’s acquisition of Xapo’s institutional custody business). Investment also grew in supply chain management, healthcare, and other verticals. At the same time, established financial players seeking greater returns for their investors are continually deploying their own “permissioned” blockchain-enabled solutions.

Overall, dealmaking in 2019 exhibited a more calculated approach than in 2018, likely as a result of what is known as the “Crypto Winter,” where the hyped valuations of several cryptocurrencies returned to normal levels or folded for lack of underlying substance.

2019 also saw both governments and tech giants focusing on the implications of blockchain products. For example, the rise of cryptocurrencies and the interest of established players has put pressure on central governments to look into crafting their own digital asset platforms. The combination of regulation and consolidation will continue to drive activity in the blockchain space.

“The rise of cryptocurrencies and the interest of established players has put pressure on central governments to look into crafting their own digital asset platforms.”

3. M&A Litigation Continues and Evolves

The focus of M&A litigation continued to change, though such litigation remains an integral piece of the public, and in some cases the private, M&A landscape.

- Shareholder Litigation. 2019 saw the effects of the movement of shareholder M&A litigation out of Delaware state courts, following those courts’ determinations in the Trulia and Corwin cases. Shareholders still challenge a majority of public acquisitions, but the bulk of those challenges have shifted to federal court, with more focus on disclosure issues than on fiduciary issues, and to some other state courts. In support of potential challenges, shareholders have continued to seek (and litigate for) access to corporate books and records.

- Contract Construction. Delaware courts in 2019 reminded parties in emphatic fashion that they will enforce the terms of the parties’ negotiated agreement. Some examples include:

- Strict Enforcement of a Termination Provision – In Vintage Rodeo Parent, LLC v. Rent-a-Center, Inc., a target company, immediately after the scheduled end date under a merger agreement, terminated the deal and demanded a $92.5M reverse termination fee, since the regulatory approval condition had not been satisfied. The buyer objected to the termination, noting, among other things, that the parties were continuing to seek regulatory approval. The Delaware Court of Chancery enforced a provision requiring the buyer to provide notice of extension of the end date, which the buyer had failed to provide.

“Delaware courts in 2019 reminded parties in emphatic fashion that they will enforce the terms of the parties’ negotiated agreement.”

- Ordering a Buyer to Close – Coming off the heels of the Delaware Supreme Court’s 2018 Akorn decision finding – for the first time – that a material adverse effect had occurred,[4] the Delaware Court of Chancery, in Channel Medsystems, Inc. v. Boston Scientific Corp., rejected a buyer’s claim that a material adverse effect had occurred and ordered the buyer to close the acquisition. The court found that, while a number of the target’s representations might have been inaccurate as of the date of the agreement, the buyer failed to prove that such inaccuracies reasonably would be expected to have a material adverse effect at the time of termination. The court also explained that the buyer “will obtain the essence of what it bargained for by closing the transaction.”

4. Shareholder Activism Drives Divestitures and Other M&A

During 2019, activist investors increasingly focused on M&A, with about 47% of all campaigns having an M&A thesis, up from about 35% in prior years.[5] Activists continued to pursue a variety of M&A-related objectives, including outright sales of targeted companies, divestitures and break-ups, and challenges to announced deals, either on the target side through traditional “bumpitrage” demands for a higher price or on the buy side by opposing a proposed acquisition.

2019 also saw:

- Convergence of Activism and Private Equity – Activist funds made numerous private equity-like investments, including by partnering with private equity funds on acquisitions. For example, Elliott Management proposed to acquire QEP Resources, and Elliott Management’s private equity arm, Evergreen Coast Capital, partnered with Siris Capital Group to acquire Travelport Worldwide and with Francisco Partners to acquire LogMeIn.

- Institutional Investors Using Activist Strategies – Prominent institutional investors turned to activist strategies to oppose M&A transactions they perceived to be unfavorable. Notable examples include Wellington Management’s public challenge to the Bristol-Myers Squibb acquisition of Celgene and T. Rowe Price’s public disclosure that it would vote against Occidental Petroleum’s directors in response to Occidental’s restructuring of its acquisition of Anadarko to avoid a shareholder vote.

- Overseas Activity – The proportion of activism aimed at non-U.S. targets continued to increase. Japan was the busiest non-U.S. jurisdiction with campaigns including Elliott Management’s criticism of Unizo’s response to takeover offers and ValueAct’s campaign against Olympus.

- SEC Rule-Making with Respect to Proxy Advisors – In August 2019, the U.S. Securities and Exchange Commission (SEC) confirmed its position that proxy voting advice issued by proxy advisors generally constitutes a “solicitation” and accordingly is subject to anti-fraud and other federal proxy rules.[6] The proxy advisory industry objected, and Institutional Shareholder Services (ISS) sued the SEC. In November 2019, the SEC proposed rules that would require proxy advisors, in order to avoid the proxy rules’ filing requirements, to disclose conflicts of interest and to interact with issuers before sharing their advice with their clients.[7]

5. National Security Concerns and Trade Tensions Complicate Deals

Heightened U.S. national security concerns and trade tensions resulted in new rules being pursued and effected that will impact M&A processes and, moreover, the value of businesses.

- Expanded CFIUS Regulations – On January 13, 2020, the Committee on Foreign Investment in the U.S. (CFIUS) published final regulations that expand the existing “pilot program” to cover, more broadly, foreign investments in U.S. businesses performing critical infrastructure functions – which include more modern security concerns, such as internet protocol networks and exchange points, data centers, and core processing services for federal financial institutions – and collecting sensitive personal data pertaining to U.S. citizens.[8] These rules are substantially similar to the proposed rules issued in September 2019.[9] Under the final rule, the principal requirements of the pilot program will be subsumed in the new regulations, rather than remain a standalone regime.

Under the regulations, a non-U.S. entity investing in a U.S. company (including a non-U.S. company with a U.S. business) will need to determine (i) whether the target company falls within the regulations' definition of a technology, infrastructure, and data (TID) U.S. business, and (ii) whether the transaction will afford the foreign investor certain key rights, such as access to “material nonpublic technical information,” board membership or observer rights, or involvement in substantive decision-making regarding the target’s TID assets, regardless of whether the investor otherwise obtains “control” (as defined broadly by CFIUS). The regulations require mandatory filings in transactions where a foreign government has a “substantial interest.”

- Reviewing Closed Deals and Punishing Violations – CFIUS actively reached out to companies involved in transactions potentially covered by CFIUS that were not notified. For example, CFIUS forced Beijing Kunlun Tech Co. Ltd. to divest its 2016 acquisition of the dating app company Grindr LLC, apparently based on concerns about the Chinese government’s potential exploitation of sensitive data relating to U.S. citizens, and pressured a partially Russian-backed investment fund, Pamplona Capital Management, to divest its minority stake in a U.S. cybersecurity firm. CFIUS also imposed the first-ever civil penalty – $1 million – for repeated violations of a mitigation agreement.

- Emerging and Foundational Technologies – The Department of Commerce is working on regulations to identify “emerging and foundational” technologies, following its November 2018 Advance Notice of Proposed Rulemaking seeking comments on 14 categories of proposed emerging technologies.[10]

- Actions Against Specific Actors – The Department of Commerce added Huawei, SenseTime, Hikvison, and other companies to its “Entity List,” thereby prohibiting these entities from obtaining any hardware, software or technology that is subject to the U.S. Export Administration Regulations.[11] The Department of Defense (and other agencies) prohibited federal agencies from buying “covered telecommunications equipment or services as a substantial or essential component of any system, or as critical technology as part of any system” from designated Chinese entities, including Huawei and ZTE.[12]

“It remains to be seen what impact the ongoing trade dispute between the U.S. and China will have on the use of the administration’s national security toolbox or whether new legislation may be proposed.”

- Supply Chain Actions – The Department of Commerce proposed regulations to address certain information and communications technology and services transactions that pose an undue risk to critical infrastructure or the digital economy in the U.S., or an unacceptable risk to U.S. national security or the safety of U.S. persons.[13]

- U.S.-China Trade Considerations -- It remains to be seen what impact the ongoing trade dispute between the U.S. and China will have on the use of the administration’s national security toolbox or whether new legislation may be proposed. The January 15, 2020 signing of a “Phase 1” trade agreement with China may alleviate trade tensions and may result in a broader trade agreement. However, the national security concerns of the U.S. government pre-date the current trade war and likely will persist regardless of whether the broader bilateral relationship improves.

6. Focus in Asia Changes

M&A activity in Asia Pacific outside Japan decreased, with outbound and domestic/intra-regional M&A value down by 29.5% and 33.5%, respectively, and inbound M&A value up only 1.3% for Q1-Q3.[14] Japan saw overall M&A deal value decline, with inbound and domestic activity increasing but outbound activity falling.[15]

Several trends are likely to affect deals in 2020:

- Take Privates of U.S.-Listed China Businesses – As U.S.-China trade tensions and national security-related investment restrictions in the U.S. continue, U.S.-listed companies with most or all of their operations in China may seek a secondary listing outside of the U.S. The next step could be another wave of take privates as such companies withdraw from U.S. capital markets.

- Sales of China Businesses of U.S. and European Companies – Some U.S. and European companies, especially those that are consumer facing or that seek to sell technology to Chinese companies, may feel “unwelcome” in the Chinese market, leading to the sale of controlling stakes in the China businesses of such companies to Chinese companies (for example, the sale of a majority stake in Carrefour’s China business to Suning (a large, non-state-owned Chinese conglomerate) completed in September 2019).

- Consolidation in Healthcare and Education Sectors – The healthcare and education sectors in Asia have benefited from the growth of the middle class in Asia and encouragement by Asian governments of increased consumer spending. Both of these sectors have presented opportunities for consolidation.

- Sales of Non-Core Businesses – If the economy in Asia sours further in 2020, more companies may seek to sell non-core businesses as they try to raise funds and refocus their businesses.

- Increasing Activity in Japan – The volume of PE buyouts in Japan is expected to continue to increase in 2020 as a number of major funds (such as Bain and Carlyle) have indicated they are raising new or additional Japan-focused buyout funds and as the Japanese government continues to press listed conglomerates to spin off subsidiaries to improve corporate governance and reduce conflicts of interest.

“The healthcare and education sectors in Asia have benefited from the growth of the middle class in Asia and encouragement by Asian governments of increased consumer spending.”

7. Brexit to Get Done

The uncertainty of Brexit cast a long shadow over the UK political scene and domestic M&A market following the Brexit referendum in 2016. During that time M&A activity and investment in relation to UK-based businesses was largely put on hold by many potential market participants, since it was unclear whether Brexit would take place and whether any Brexit would be with a withdrawal agreement between the UK and the rest of the EU or reliant on the WTO fall back position with the potential of material friction affecting exports and imports. That shadow – at least insofar as it is now clear that Brexit will indeed take place – was lifted by the UK general election in December 2019 and with that has come an upsurge of interest in UK businesses and M&A.

The full details of the future relationship between the UK and the remaining members of the EU have yet to be agreed. Although that process may continue to provide a slight drag on UK domestic M&A, the main concern for cross-border European M&A is the relative weakness of the main economies in the Eurozone.

In addition, Europe does not have a technology ecosystem that is as well developed as the system in the U.S., especially the U.S. West Coast. This means that there is not a comparable pipeline of large emerging companies presenting investment and M&A opportunities. Some European companies, including portfolio companies of private equity sponsors, have sought to expand through acquisitions of such companies in the U.S.

“Europe continues to have a large number of strong strategics in a wide range of sectors who remain well placed to consolidate their market positions through M&A.”

More encouragingly, Europe continues to have a large number of strong strategics in a wide range of sectors who are well placed to consolidate their market positions through M&A, both in Europe and in other regions. Also, private equity sponsors participating in the European markets have similar cash fire power as private equity sponsors elsewhere. They continue to drive significant amounts of M&A business in Europe and look set to continue to do so against a background of readily available debt.

8. Antitrust Populism & Scrutiny of Technology Deals Likely to Intensify in 2020

Proponents of stricter antitrust enforcement are clamoring for antitrust agencies to include an assessment of whether a transaction is likely to harm jobs, employee wages, privacy rights, or the ability of smaller businesses and entrepreneurs to compete. The calls for more stringent standards and aggressive enforcement have focused particularly on “Big Tech” and “Big Pharma” companies, as well as firms in other industries, where patent-protected innovations, platform-based business models, and data-driven insights provide significant competitive advantages or may generate “winner-take-all” network effects.

U.S. and European enforcement agencies have taken notice of the policy debate. For example:

- New Technology Enforcement Division – The U.S. Federal Trade Commission (FTC) announced that it would establish a new Technology Enforcement Division to focus on potentially anticompetitive mergers or practices in “markets for online advertising, social networking, mobile operating systems and apps, and platform businesses.”

- “Killer Acquisitions” and “Nascent” Competition – According to press reports, the FTC is investigating whether several of Facebook’s long-ago consummated deals, such as Instagram (acquired in 2012) or WhatsApp (acquired in 2014), were so-called “killer acquisitions” aimed at eliminating potential future rivals or “nascent” competitors before they could become a threat. Similarly, concerns about preventing future potential competition were present in the FTC’s challenge of Illumina’s proposed $1.2 billion takeover of PacBio to prevent Illumina from “extinguishing PacBio as a nascent competitive threat” even though their current market activities were largely in different markets. The FTC was also concerned that the transaction would reduce the combined firm’s incentive to innovate and develop new products. Illumina and PacBio abandoned their transaction shortly after the FTC filed its complaint. Similarly, the U.S. Department of Justice (DOJ) recently challenged Sabre Corp.’s planned $360 million acquisition of airline booking company Farelogix Inc based on concerns that the transaction was designed “to take out a disruptive competitor that has been an important source of competition and innovation.”

- Online Platforms – The DOJ announced that it would review whether market-leading online platforms, such as Google and other tech firms, have achieved market power and are engaging in practices that have reduced competition, stifled innovation, or otherwise harmed consumers (for example, by using data gathered from customers to block rivals from competing).

“The calls for more stringent standards and aggressive enforcement have focused particularly on ‘Big Tech’ and ‘Big Pharma’ companies.”

- Actions in Europe – The EC published Competition Policy for the Digital Era,[16] an advisory report on merger enforcement examining (i) the role that data accumulation plays in creating entry barriers and (ii) whether the EU should amend its notification thresholds to require filings to preserve the EC’s ability to review “killer acquisitions” of nascent competitors. The EC’s Chief Competition Economist has advocated for reversing the burden of proof for these acquisitions to force merging parties to prove the efficiencies arising from their transaction.

9. Private Equity: More Money, More Competition, More Creativity

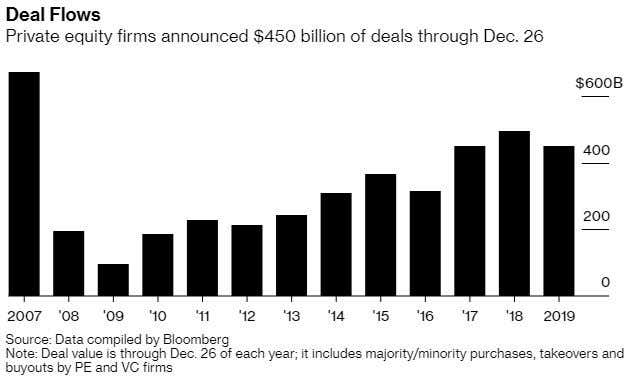

2019 saw roughly $450 billion of private equity deals, a modest decrease from 2018. In addition to traditional buyouts of public and more mature companies with relatively strong cash flows, private equity firms bought younger firms and engaged in growth equity, joint ventures and other majority or minority investments with greater frequency in 2019. Terms and interest rates remained favorable throughout 2019 for borrowers in leveraged deals, adding to the competitiveness to deploy capital, but creating opportunities for positive-return exits. Exits fell moderately, with secondary buyouts accounting for an increasing proportion of overall exits.

In 2020, private equity firms will be armed with a record level of cash, as private equity firms at the end of 2019 held almost $1.5 trillion in unspent capital (or “dry powder”).[17] Combined with the current debt market, this provides massive investment potential.

The biggest challenges in 2020 will be the geopolitical and macroeconomic factors affecting the overall M&A market described above, including potential economic downturns, the 2020 U.S. elections (in which some candidates have proposed legislation aimed directly at the private equity industry), and the U.S.-China trade dispute. Private equity funds must also continue to grapple with the enhanced competitiveness of the middle market, with the field of investors expanding to include sovereign wealth funds, venture capital firms, family offices and independent sponsors capable of writing bigger checks and pursuing direct control investments more often than ever before.

Nevertheless, we expect private equity sponsors to remain active and to continue to look for opportunities to deploy their record-breaking capital in creative ways. This activity should continue, and build upon, trends seen in 2019, including an increased focus on portfolio company “add-on” transactions, “roll-up” strategies designed to create market-leading participants rather than acquiring existing, mature participants, and continued expansion of a sponsor’s typical investment scope (with respect to both sector and geographic focus). Sponsors are also expected to engage in more opportunistic pursuit of exit transactions (particularly if concerns of a broader economic slowdown become more pronounced).

[1] Refinitiv.

[2] Refinitiv.

[3] Refinitiv.

[4] For more information on Akorn, see our prior client alert, https://www.mofo.com/resources/insights/181210-delaware-material-adverse-effect.html.

[5] Lazard, 2019 Review of Shareholder Activism.

[6] https://www.sec.gov/rules/interp/2019/34-86721.pdf.

[7] https://www.sec.gov/rules/proposed/2019/34-87457.pdf.

[8] https://s3.amazonaws.com/public-inspection.federalregister.gov/2020-00188.pdf; https://s3.amazonaws.com/public-inspection.federalregister.gov/2020-00187.pdf.

[9] For more information see our series of client alerts on the proposed and final rules, Part 1 Key Takeaways https://www.mofo.com/resources/publications/190924-foreign-investment-2020-modernized-cfius-regulations.html; Part 2 Real Estate Investments https://www.mofo.com/resources/publications/191001-foreign-investment-2020-part-2.html; Part 3 Technology, Infrastructure, Personal Data https://www.mofo.com/resources/publications/191015-foreign-investment-2020.html; Part 4 Who’s In, Who’s Out, and Why It Matters https://www.mofo.com/resources/insights/191121-foreign-investment-2020.html; Part 5 Final CFIUS Rules Announced (forthcoming on Morrison & Foerster’s National Security Practice webpage: https://www.mofo.com/capabilities/national-security.html#overview).

[10] https://www.federalregister.gov/documents/2018/11/19/2018-25221/review-of-controls-for-certain-emerging-technologies.

[11] For more information see our client alerts, https://www.mofo.com/resources/insights/190516-chinese-telecom-companies-under-fire.html and https://www.mofo.com/resources/insights/191009-commerce-adds-28-chinese-organizations-bis-entity-list.html.

[12] For more information see our client alert, https://www.mofo.com/resources/insights/190809-new-rule-ndaa-prohibition.html. A broader prohibition that prohibits government agencies from entering contracts with entities that use covered equipment, services, or technology will become effective August 13, 2020, subject to forthcoming regulations.

[13] https://www.govinfo.gov/content/pkg/FR-2019-11-27/pdf/2019-25554.pdf.

[14] Mergermarket Asia Pacific Trend Summary, Q1-Q3 2019.

[15] Refinitiv.

[16] https://ec.europa.eu/competition/publications/reports/kd0419345enn.pdf.

[17] Private Equity is Starting 2020 with More Cash Than Ever Before, Bloomberg LLP (Jan. 1, 2020).

- Michael G. O'BryanPartner

- Marcia EllisPartner

- Charles L. CapitoPartner

- Joseph SulzbachPartner

- Patrick D. HuardGlobal Co-Chair of Private Equity Practice