FDA Approves 25th Biosimilar

On November 15, 2019, FDA approved Pfizer’s adalimumab product, a biosimilar to AbbVie’s Humira, marking the 25th approval of a biosimilar under the Biologics Price Competition and Innovation Act (BPCIA). A biosimilar is a product that is “highly similar” to a branded reference biologic product “notwithstanding minor differences in clinically inactive components” and that exhibits “no clinically meaningful differences” as compared to the branded product in terms of “safety, purity, and potency.” 42 U.S.C. § 262(i)(2). The road to the 25th approval has been long and has involved some of the biggest companies and medications in the pharmaceutical industry. In this article, we take a brief look at how we got here, where things currently stand for the 25 approved biosimilars, and where we are headed.

How We Got Here

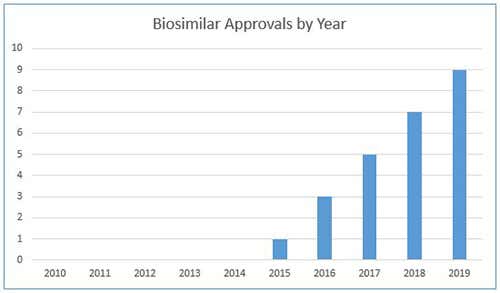

The BPCIA was enacted in March 2010, as part of the Affordable Care Act. FDA issued its first biosimilar approval five years later, with the approval of Sandoz’s filgrastim product, a biosimilar to Amgen’s Neupogen, in March 2015. Although only four biosimilars had been approved through the end 2016, FDA issued a torrent of biosimilar approvals over the next three years, including nine approvals in 2019 alone. The yearly trend in FDA approval of biosimilars is shown in the chart below.

Based on its public statements and publications, including the July 2018 Biosimilar Action Plan, FDA is expected to continue to make biosimilar review and approval a top priority.

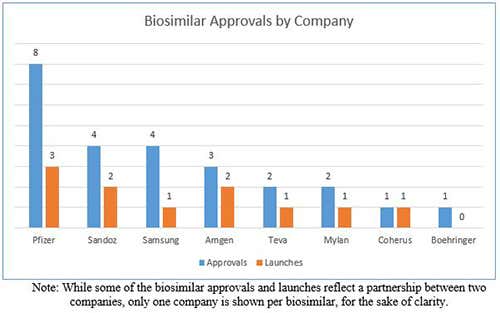

Thus far, FDA has approved biosimilars for nine branded biologic products, which include some of the biggest blockbuster pharmaceutical products in the world. The breakdown of the 25 biosimilar approvals with respect to their branded counterparts is as follows: Humira (5 biosimilar approvals), Herceptin (5), Remicade (3), Neulasta (3), Rituxan (2), Avastin (2), Enbrel (2), Neupogen (2), Epogen (1). The branded biologics on this list belong to just four companies: Genentech, Amgen, AbbVie, and Johnson & Johnson. By contrast, more than a dozen companies have secured biosimilar approvals or have otherwise partnered with the biosimilar applicants. The chart below shows the number of biosimilar approvals that each company has secured and the corresponding number of product launches in the U.S.

It is noteworthy that biosimilar applicants include not only companies that have traditionally focused on marketing generic drugs but also companies that have primarily focused on branded drugs. Pfizer, for example, which markets dozens of branded pharmaceuticals, leads all biosimilar applicants with eight approvals and three launches. And Amgen, which has seen its biologics portfolio encounter biosimilar competition, has committed to developing biosimilars of its own and has already launched two such products in the U.S.

Litigation, Settlement, and Launch

The “patent dance” provisions of the BPCIA lay out procedures designed to streamline the resolution of patent disputes prior to approval and launch of biosimilar products. All but five of the 25 approved biosimilars have been subject to patent litigation under the BPCIA. As of this writing, nine of the approved 25 products remain in active litigation, including several on appeal to the Federal Circuit. And while some important biosimilar cases have been decided by the courts, including the landmark Sandoz v. Amgen case decided by the Supreme Court in 2017 (in which Morrison & Foerster represented Sandoz), a high percentage of cases have concluded by settlement. Indeed, nearly half of the approved biosimilars (11 out of 25) involve settlements between the biosimilar applicants and the branded biologic companies. Those settlements either resolved pending litigation or resolved patent disputes prior to litigation, including during the patent dance. It is clear that settlements have played an important role in the resolution of biosimilar disputes.

But neither approval nor settlement translates into immediate launch. Although FDA has approved 25 biosimilars, only 11 out of the 25 products have launched in the U.S. Of those, only one product was launched pursuant to settlement. The others were launched “at risk” to varying degrees, i.e., the launches occurred while patent litigation was ongoing, although some launches occurred following favorable court decisions but before all appeals had been exhausted. The launch status of the 25 approved biosimilars can be summarized as follows:

- Number of launches at risk: 10

- Number of launches pursuant to licensed entry date from settlement: 1

- Number of launches awaiting licensed entry date from settlement: 10

- Number of biosimilars not settled and not launched: 4

Thus, while FDA has approved 25 biosimilars and the applicants for 11 of those products have settled their patent disputes with the branded companies, the vast majority of biosimilar launches in the U.S. have been made without settlement and without final court decisions.

Finally, biosimilars have launched against each of the nine biologic products with approved biosimilars except for Amgen’s Enbrel and AbbVie’s Humira. Enbrel (etanercept) has two approved biosimilars, both of which are embroiled in ongoing litigation. Humira (adalimumab) has five approved biosimilars but no active litigation. All five of the approved biosimilar applicants for Humira, and several other non-approved biosimilars, have settled with AbbVie for licensed entry dates in 2023 in the U.S.

Where We Are Headed

FDA approval of biosimilars is not likely to slow down any time soon. But some lingering questions remain. One major issue is when FDA will issue the first award of interchangeability for a biosimilar product and whether interchangeability status will be routinely awarded thereafter. Interchangeability is a more stringent classification of a biosimilar product, requiring a showing that the product “can be expected to produce the same clinical result as the reference product in any given patient.” 42 U.S.C. § 262 (k)(4)(A)(ii). Importantly, the interchangeability designation facilitates automatic pharmacy substitution and is therefore coveted by biosimilar applicants. Although no biosimilar has yet been awarded interchangeable status, FDA finalized its guidance on interchangeability in May 2019, paving the way for future products to receive this designation.

The intersection of antitrust laws and biosimilar marketing will also be an area of focus in the coming months. Earlier this year, indirect purchasers filed a class action lawsuit alleging that AbbVie and several biosimilar applicants, through their settlement agreements, violated antitrust laws to delay the availability of Humira biosimilars in the U.S. The outcome of that litigation could have a dampening effect on the settlement of BPCIA patent disputes. A different antitrust issue is at play in a 2017 lawsuit filed by Pfizer against Johnson & Johnson. In that case, Pfizer alleges that J&J has engaged in exclusionary contracts and anti-competitive practices related to the Remicade biologic. Pfizer alleges that J&J’s practices have effectively denied patients access to Pfizer’s biosimilar version of the drug and have undermined price competition in the biologics marketplace. The case has survived a motion to dismiss and could impact the manner in which biologics and biosimilars are marketed.

Another item on the horizon is the 10-year anniversary of the BPCIA on March 23, 2020. That date is important because it marks the transition date for certain biological products, such as insulin, that have been governed under the Federal Food, Drug, and Cosmetic Act. On March 23, 2020, the marketing applications for such products will be governed by the Public Health Service Act. As a result, these biological products will be subject to biosimilar competition under the BPCIA.

Lastly, the constitutionality of the ACA may impact the fate of the BPCIA. A 2018 decision from a Texas federal court held that the ACA as a whole is unconstitutional, and that decision is currently on appeal. Because the BPCIA is part of the ACA, it is possible that the BPCIA could become null and void in the near future. But it is also possible that the BPCIA could be severed from the scope of any ACA decision and emerge unscathed. Even if the BPCIA ceases to exist as such, Congress and FDA will undoubtedly fashion a replacement mechanism for the biosimilar approval process. Therefore, a successful challenge to the constitutionality of the ACA is likely to be a temporary setback at most and not the death knell for biosimilars.

FDA’s approval of the 25th biosimilar comes at a fertile time in the development of the biosimilar industry, including multiple recent launches in the U.S. and important developments in biosimilar litigation and regulation. Despite a looming specter of BPCIA unconstitutionality, biosimilars are not likely to disappear any time soon.

Practices

Industries + Issues